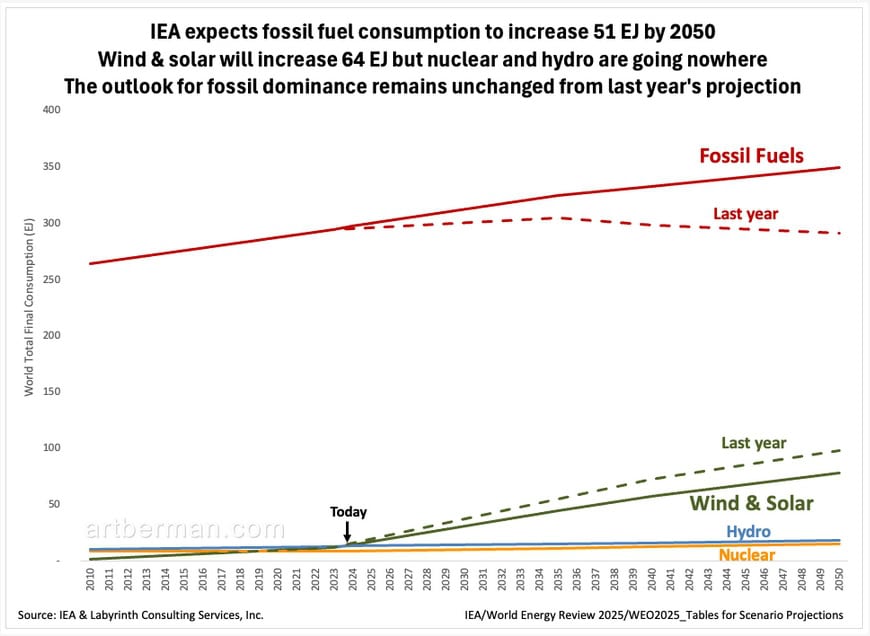

The International Energy Agency made headlines last week by admitting that oil demand isn’t peaking. That got everyone’s attention but the agency’s outlook was nearly identical to last year’s version: fossil fuels have and will continue to dominate energy consumption (Figure 1).

Figure 1. IEA expects fossil fuel consumption to increase 51 EJ by 2050. Wind & solar will increase 64 EJ but nuclear and hydro are going nowhere. The outlook for fossil dominance remains unchanged from last year’s projection. Source: IEA & Labyrinth Consulting Services, Inc. Click on the image to enlarge.

|

According to the IEA’s own data in Figure 1, wind and solar make up less than 3% of global energy consumption. Every year, the IEA shows that the renewable rocket is about to launch—next year. Somehow it never does.

This is a symptom of Renewable Derangement Syndrome: the belief that an “energy transition” is well underway, despite clear evidence to the contrary. It’s the conviction that solar panels and wind turbines are replacing fossil fuels at scale when, in fact, renewables remain a rounding error in global energy supply.

The Australian Energy Council just issued a warning: the energy transition is at a tipping point. Affordability is now a real threat, and public support is beginning to weaken. Renewables aren’t expensive because of the panels—they’re expensive because of everything around them: transmission infrastructure, expanded grid networks, and years‑long approval processes that slow projects and inflate budgets. Then there’s the cost of firming—batteries, natural gas peaker plants, and pumped hydro. Wind and solar are intermittent and don’t show up on demand. Add to that the maze of overlapping rules and permitting delays, and you begin to understand that replacing fossil fuels with renewable energy is not as simple as many assumed.

RDS isn’t just wishful thinking—it’s delusional optimism untethered from math, physics, or history. People with RDS mistake capacity for supply and equipment cost for system price. They ignore the hidden costs of intermittency, storage, and massive grid upgrades. They act like energy transitions happen by press release, not by bulldozers and industrial scale buildouts.

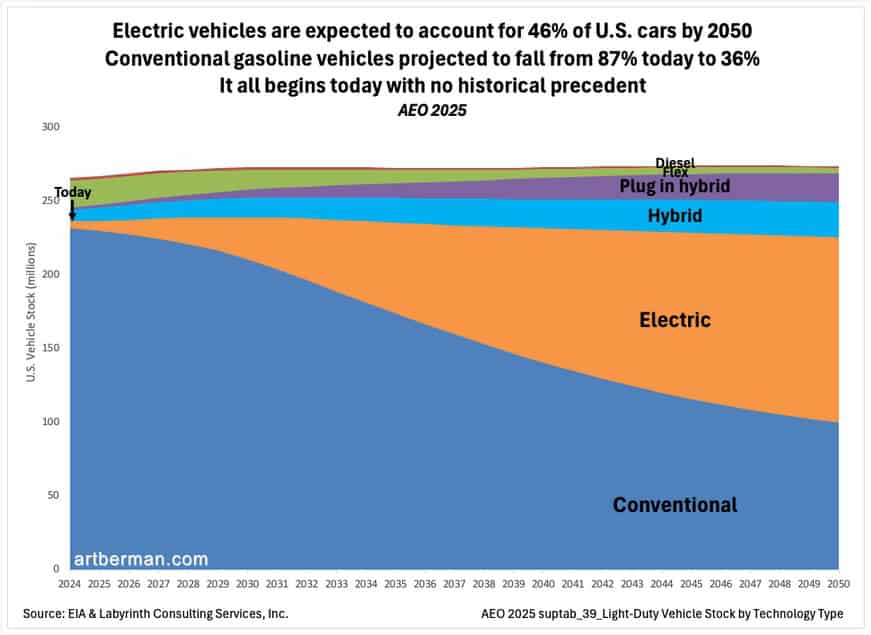

And it’s not just renewables.The same syndrome extends to electric vehicles, where hype seems to trump perfomance and price. Ford is discontinuing its electric F-150 and EV sales are slowing across major markets. GM recently laid off over 1,700 workers and idled plants amid sluggish demand and shifting regulations. The rocket isn’t launching—it’s stalled on the pad.

The U.S. Energy Information Administration projects that EVs will account for almost half (46%) of all light vehicles in the United States by 2050, with gasoline vehicles falling from 87% today to 36% (Figure 2). Just like with renewables, it starts tomorrow. EVs are only 3% of the U.S. car fleet today.

Figure 2. Electric vehicles are expected to account for 46% of U.S. cars by 2050. Conventional gasoline vehicles projected to fall from 87% today to 36%. It all begins today with no historical precedent. Source: EIA & Labyrinth Consulting Services, Inc. Click on the image to enlarge.

|

The EIA provides a 14-page document on assumptions behind this projection but never explains how it gets from 3% to 46%. Instead, it assumes that batteries get cheaper, regulations tighten, subsidies persist, charging infrastructure appears, and consumers follow modeled behavior. The EIA isn’t forecasting EV growth—it’s assuming it. And those assumptions are already breaking down.

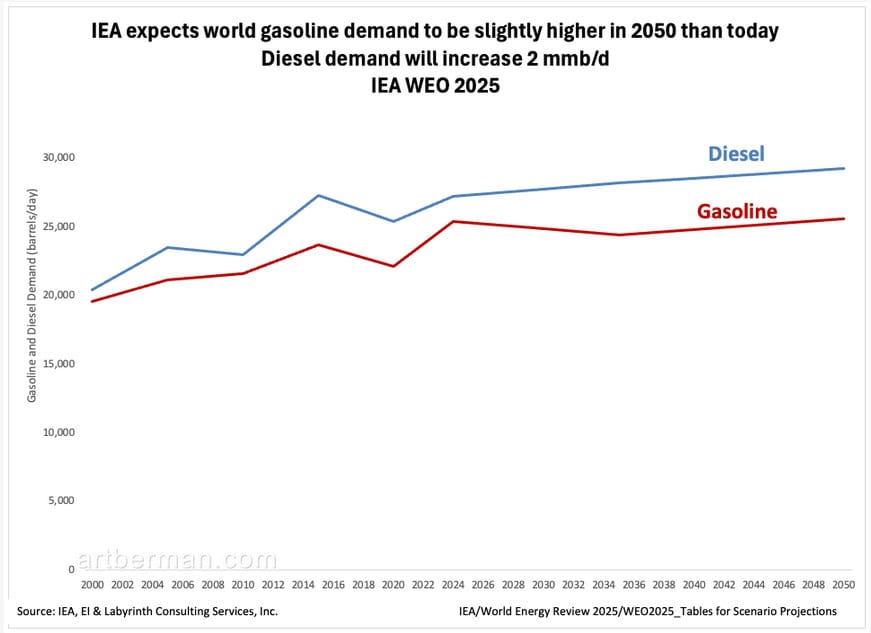

Analysts often claim EVs are driving down gasoline demand. Except they’re not. The IEA projects gasoline demand will be slightly higher in 2050 than today (Figure 3). There’s a modest dip through 2035, followed by a rebound—with no real explanation. Another meme bites the dust. Gasoline use might be higher without EVs, but they’re clearly not killing demand.

Figure 3. IEA expects world gasoline demand to be slightly higher in 2050 than today. Diesel demand will increase 2 mmb/d. Source: IEA, EI & Labyrinth Consulting Services, Inc. Click on the image to enlarge.

|

The IEA claims EVs will displace over 10 million barrels of oil per day by 2035, based on EVs reaching 50% of sales. But this theoretical estimate assumes each EV replaces a gasoline car one-for-one. It ignores rising ICE efficiency, rebound driving effects, and lumps diesel and LPG in with gasoline. It sounds precise, but it’s mostly fiction.

A better way to estimate displacement is to compare the IEA’s gasoline and diesel curves in Figure 3. Had gasoline followed diesel’s trajectory, the difference implies EVs will displace about 1.9 mmb/d from 2024 to 2035—about 176,000 barrels per day per year. IEA’s headline claim of 10 million barrels per day is five times more than that. Why didn’t they check? Because once a narrative takes hold, the data is secondary.

This isn’t a defense of oil, or the idea that fossil supply and demand can grow forever. That’s just another kind of fantasy. I think the “oil glut” story is overstated, but oversupply is still a likely outcome. These debates all point to a deeper issue: a global growth slowdown that’s been unfolding for years.

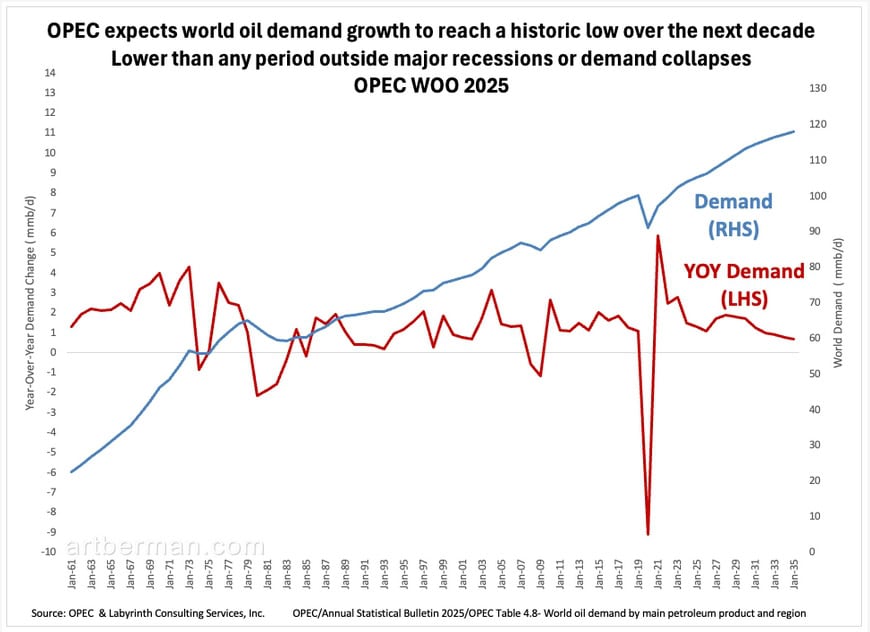

Oil and financial markets care more about demand rates than levels. Even with the IEA walking back its peak oil rhetoric, demand growth is on track to hit historic lows over the next decade based on IEA, OPEC, and EIA projections (Figure 4).

Figure 4. World Oil Demand Growth Set to Hit Historic Lows Over the Next Decade Despite Rising Demand Levels (Shown as the average of IEA, OPEC, and EIA projections). Source: IEA, OPEC, EIA & Labyrinth Consulting Services, Inc. Click on the image to enlarge.

|

OPEC is the most optimistic, projecting global demand to exceed 117 mmb/d by 2035 (Figure 5). But even that bullish outlook implies the weakest decade of demand growth on record—slower than past recessions or demand shocks.

Figure 5. OPEC expects world oil demand growth to a reach historic low over the next decade. Lower than any period outside major recessions or demand collapses (shown using OPEC World Oil Outlook 2025). Source: OPEC & Labyrinth Consulting Services, Inc. Click on the image to enlarge.

|

OPEC expects strong economic growth, rising populations, more vehicles on the road, more air travel and freight, and steady petrochemical demand. All bullish on the surface—until you look at the year-over-year math. Between 2030 (113.3 mmb/d) and 2035 (117.9 mmb/d), demand rises just 4.6 mmb/d. That’s 920 kb/d per year.

From 2011 to 2025—excluding the pandemic—the average annual increase was 1,590 kb/d. Even OPEC’s optimistic forecast shows a nearly 40% slowdown in growth.

The implications are profound. We’re approaching structural, economic, or physical limits to demand. This isn’t caused by war or pandemic—it’s business-as-usual. As Ray Dalio points out, we’re in the late stage of a long-term global cycle marked by debt, disorder, and institutional decay. History offers clues about what follows, but the outcome depends on whether societies choose cooperation or confrontation. Right now, it looks like the latter.

Demand isn’t just about technology and GDP—it’s also about affordability, and how much financial overshoot props up the system. That’s the part these forecasts miss. Slowing demand growth is a reflection of economic stress—not for the average person, but for the median one. When analysts talk about “peak demand,” they imagine a smooth, transition with smarter technology, better efficiency, and painless substitution. But the real driver and hard limit is affordability.

The IEA’s World Energy Outlook 2025 prompted a long-overdue reappraisal of the peak demand narrative. Some read it as an “all clear” for oil—and by extension, for the fossil-fueled growth model. That’s a mistake. The real signal is this: we’re at the edge of what this system can deliver. Growth isn’t accelerating. It’s fading into a long twilight.

By the same author:

The Nuclear Golden Calf

|

ABOUT THE AUTHOR

Art Berman is Director of Labyrinth Consulting Services, Sugar Land, Texas, and a world-renowned energy consultant with expertise based on over 40 years of experience working as a petroleum geologist. Visit his website, Shattering Energy Myths: One Fact at a Time, and learn more about Art here.

|