For more than two decades, governments, international agencies, and corporations have promoted the false hope of an “energy transition.” History shows otherwise. There are no examples of true transitions—only new energy sources added on top of old ones.

The theory was that if we replace fossil fuels with renewables, emissions will fall and the climate-change problem is solved. But the reality is that no credible outlook shows fossil fuel use falling enough to reduce emissions in a meaningful way.

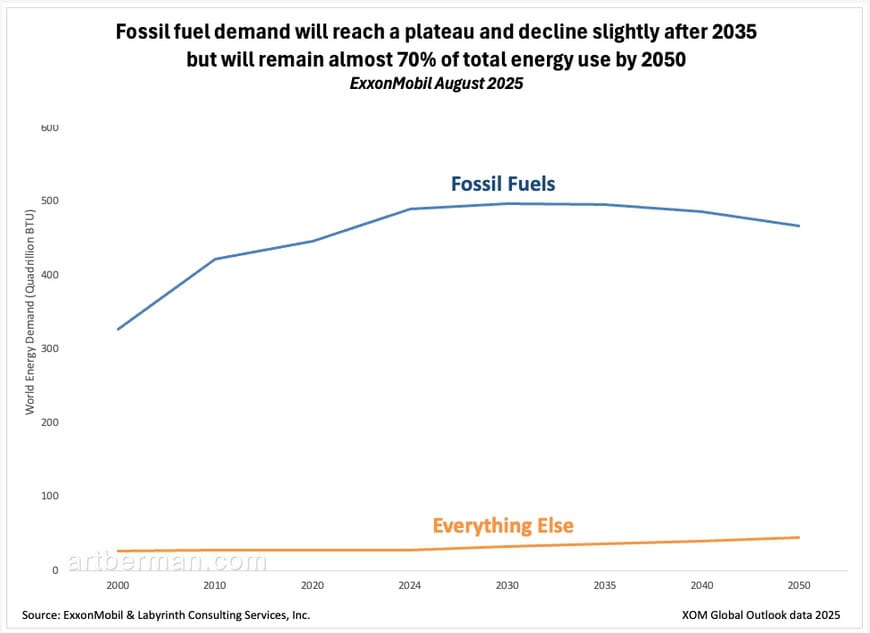

ExxonMobil’s Global Outlook 2025 paints a grim picture for those who believe in a real transition to renewables. There’s no “peak demand” for fossil fuels—only a plateau, with a slight decline after 2035, but fossil energy still makes up nearly 70% of the energy mix in 2050 (Figure 1).

Figure 1. Fossil fuel demand will reach a plateau and decline slightly after 2035 but will remain almost 70% of total energy use by 2050. Source: ExxonMobil & Labyrinth Consulting Services, Inc. Click on the image to enlarge.

|

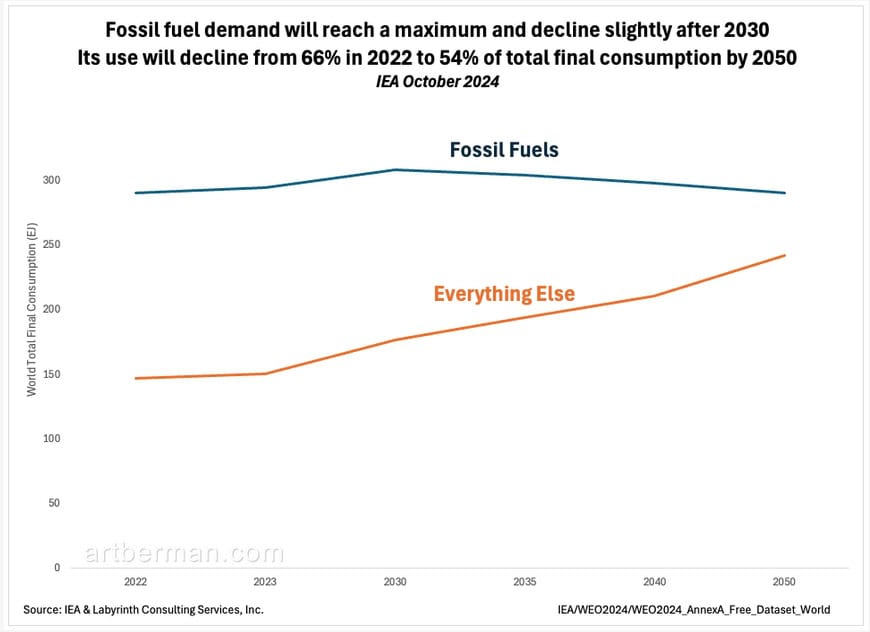

The IEA’s World Energy Outlook 2024 shows a similar path, with stronger growth in non-fossil energy, but fossil volumes barely move—meaning emissions remain stubbornly high (Figure 2).

Figure 2. Fossil fuel demand will reach a maximum and decline slightly after 2030. Its use will decline from 66% in 2022 to 54% of total final consumption by 2050. Source: IEA & Labyrinth Consulting Services, Inc. Click on the image to enlarge.

|

The deeper problem is scale. Both projections assume total energy use keeps rising, which means a larger human footprint: more extraction, more waste, more pressure on ecosystems. Even if the mix shifts slightly toward non-fossil sources, the overall scale drives ecological overshoot. Worse, both forecasts assume global GDP doubles by 2050, a bet that rests on cheap, abundant energy. But affordability is already breaking down. If energy use stalls, so will GDP. That may ease pressure on the planet, but it introduces another layer of economic fragility.

French President Macron warned in 2022 that the “era of abundance” was over. Last week, German Chancellor Friedrich Merz admitted that Germany can no longer finance its welfare state from domestic output. That crisis is rooted in energy, and it is hard to see how subsidies for renewables can be sustained. After two decades of the Energiewende, fossil fuels still make up about 75% of Germany’s energy use, while electricity prices remain among the highest in the developed world.

Cracks in the transition story are showing up everywhere. The Net-Zero Banking Alliance has lost Goldman, JPMorgan, Citi, HSBC, and Barclays. Ørsted, once the darling of green finance, has lost 86% of its value since 2021 because of rising costs, broken supply chains, and political hostility. Corporate sustainability has flipped from bold pledges to retreat. Oil companies like BP that once championed net-zero roadmaps are retreating to core oil and gas projects. AI has stolen the investment spotlight, and ESG has lost its shine.

Global clean-energy investment hit a record in early 2025, but most of it came from China and parts of Europe, where state support remains strong. Even at those levels, spending is less than a third of what’s needed annually to reach net-zero targets by 2050. U.S. investment has collapsed under policy reversals and open hostility from the Trump administration. Credit markets are backing away. Offshore wind is in crisis. Costs, politics, and scale are undermining the credibility of the transition narrative.

Covid exposed the fragility of the very structure that supports society. Demand collapsed overnight, supply chains broke, and oil and gas shrank. It struck a blow to the long era of energy surplus, with the problems exposed by the 2008 financial crisis still largely unresolved. It’s easy to think that Covid’s disruption is behind us now but the trillions in new debt piled on during the crisis was a body blow to the old order built on abundance. The world will never be the same.

What was once an integrated energy supply system is now fractured, less efficient, and more expensive. Traders may say prices are low now, but they are already too high for many. Pakistan has walked away from LNG cargoes it cannot afford, and even China has balked at Putin’s Power of Siberia pipeline. The cracks in energy and finance are converging into a more brittle, more costly system.

Jean-Baptiste Fressoz is right that the very idea of an energy transition is not just wrong, it’s dangerous. It gives the false expectation that replacement of fossil fuels by renewables is possible, and that growth and living standards can carry on unchanged. But old fuels never disappear. Renewables are built on fossil foundations. Mining, cement, steel, and global supply chains all run on hydrocarbons. Even efficiency gains depend on cheap fossil energy.

What we’re left with is more consumption, more debt, more ecological overshoot, and a political economy built on cheap energy that no longer exists. Prosperity is now out of reach for many households, businesses, and even nations. That collapse in affordability is the real fuel behind today’s populist revolt against the old order and its elites.

The energy transition bet everything on renewables replacing fossil fuels and on the promise that growth could continue without much disruption to ordinary life. If ever there were a too-good-to-be-true story, that was it. We should have seen the fallacy long ago—but we didn’t want to.

There was never a Plan B. I don’t have one either, but it’s past time to face the predicament head-on. Doubling down on a failed model isn’t the answer, and pretending otherwise is just stupid.

By the same author:

Beyond Surplus: Rethinking How Civilizations Rose

|

ABOUT THE AUTHOR

Art Berman is Director of Labyrinth Consulting Services, Sugar Land, Texas, and a world-renowned energy consultant with expertise based on over 40 years of experience working as a petroleum geologist. Visit his website, Shattering Energy Myths: One Fact at a Time, and learn more about Art here.

|