In the wake of a rapidly evolving realignment of the world trading system

resulting from the

economic equivalent of World War III, President Joe Biden last week

took the first of what are likely to be many steps toward building greater

self-sufficiency for the United States.

Biden called for increasing

U.S. production of key minerals used in the manufacture of electric

vehicle batteries. He invoked the Defense

Production Act which allows the government to support production of

certain materials and goods deemed essential for national defense and even

to order industry to mine minerals and make machinery including vehicles

such as tanks and bombs.

For the Biden administration its first small step toward U.S. self-sufficiency consists of making companies

which mine minerals key to electric vehicle batteries such as lithium,

nickel, graphite, cobalt and manganese eligible for direct subsidies or

purchase commitments to incentivize increased production. The applicable

program (called Title III) has about $750 million to spend, not that much

to rectify what is a huge deficit.

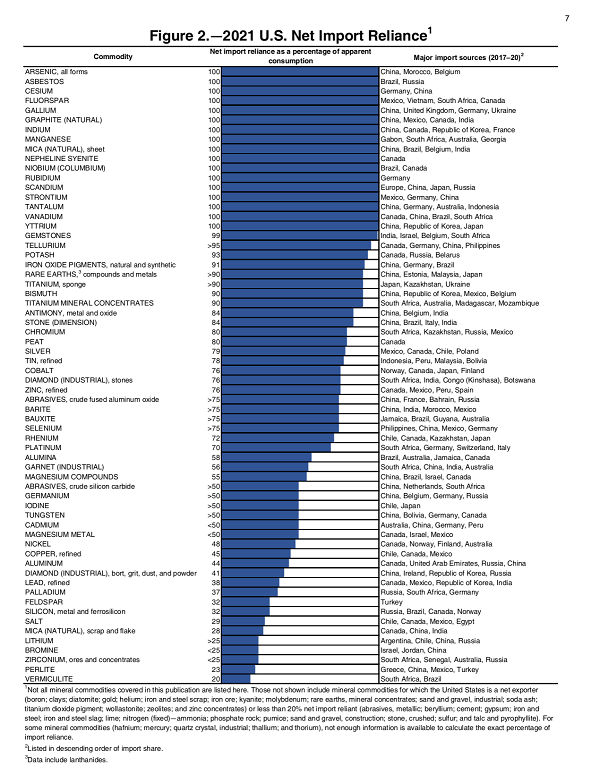

It's worth looking at U.S. net imports of each of these minerals to

understand just how hard reaching self-sufficiency will be. For starters,

let's examine a table from a U.S.

Geological Survey (USGS) report about U.S. import dependence for key

minerals:

Click the image to enlarge.

Of the five minerals listed above, the United States is 100 percent

dependent on imports for two: graphite and manganese. (It's worth noting

that China,

Russia and Ukraine are among the top six producers of graphite and

China is the largest producer by far. China

and Ukraine are among the top five producers of manganese and again

China is by far the biggest producer.)

Complete U.S. dependence on imports implies that there is no current

production of these minerals in the United States and that nobody has even

been looking for these minerals on U.S. soil. In a

2022 report the USGS confirms that "[g]raphite has not been produced

in the U.S. since the 1950s." This 2017

USGS report shows U.S. reserves of manganese to be exactly zero.

Again, this almost certainly means that there is no mining production

unless the USGS missed something.

(There are known deposits of "nodules" containing significant amounts of

manganese distributed on the world's seabeds. However, there is no

commercially available technology for mining these and their future as a

source of manganese remains uncertain. Moreover, they involve exploiting

minerals that are not exactly on U.S. soil though they may in some cases

be found in what is called the United States' "Exclusive

Economic Zone" extending out into the high seas.)

As a consequence of all this, it is unlikely that subsidies can help

increase production before the end of the decade, if ever. This is because

a mining company would first have to find commercial deposits of

these minerals before beginning to delineate their scope, raise money for

their development and then actually build the mine. This assumes, of

course, that someone will also build sufficient industrial infrastructure

to process these ores into something usable for the industries that need

these minerals and the government that has promised to buy them. (For the

technically minded, here is a

short summary of the obstacles facing such processors regarding

manganese.)

At best it would take several years for all this to happen. And, the

mining company would be taking a risk that subsidies or purchase

commitments might not be renewed since the development time could span two

or more administrations. It is possible, of course, that no commercially

attractive deposits would be found and efforts to restart graphite and

manganese production in the United States would fail.

For cobalt the obstacles are similar though the United States produces

some of the cobalt it uses, about 24 percent. There are known

deposits of cobalt in the United States. Whether they are

commercially viable would have to be determined. Most of the other

difficulties that apply to graphite and manganese would also apply to

cobalt.

The United States imports about half the nickel it uses and only 25

percent of the lithium it needs. These are better candidates for

government incentives since there is active infrastructure, and mining of the existing

and substantial commercially viable deposits could likely be expanded. One

of the main questions here will be the environmental consequences. Environmentalists

are concerned that companies will use the government's desire to develop

more domestic production to ignore environmental regulations.

The development of additional capacity could still take years to bring to

fruition. There is no quick way to develop mines and the infrastructure

around them short of a complete government takeover that requires no

private investment and ignores costs and possibly safety and environmental requirements.

And, that brings us to one of the major obstacles to national

self-sufficiency. We have created a system that is based almost

exclusively on private economic actors who must convince private investors

to plow money into any mining project. And, the market for minerals is

generally worldwide so world prices govern which deposits will be viable.

That means that high-cost domestic deposits are never developed or, if

developed, fail miserably when prices fall. The

sad story of the rare earths Mountain Pass mine in California is

instructive. This high-cost problem would imply that national

self-sufficiency (or least reduced dependence on imports) would require

ongoing price supports for the domestically mined minerals we deem most

critical. No one is talking about that, and I doubt they ever will because

it runs counter to the free-market laissez-faire ideology of those

currently in charge of the world economy. And these leaders cannot yet

fully imagine a world where de-globalization continues far into the

future.

|

ABOUT THE AUTHORS

Kurt Cobb is a freelance writer and communications consultant who writes frequently about energy and environment. His work has appeared in The Christian Science Monitor, Resilience, Common Dreams, Naked Capitalism, Le Monde Diplomatique, Oilprice.com, OilVoice, TalkMarkets, Investing.com, Business Insider and many other places. He is the author of an oil-themed novel entitled Prelude and has a widely followed blog called Resource Insights. Point of contact: kurtcobb2001@yahoo.com.

|