|

Introduction

Common wisdom assumes that economics is a positive science which eschews all values such as those embedded in a system of morality. Conversely, there are many who argue that even a positive science such as economics cannot avoid values: Values are embedded in economics as in many other sciences (see, e.g. Caplin and Schotter 2008).

At the other end of the spectrum of ideas, the practical end, there is a burgeoning literature that goes under the banner of The Economics of Religion. The field is so vigorous today as to have gained its own JEL code, Z12, and to have formed its own professional organization, the Association for the Study of Religion, Economics, and Culture (ASREC). This literature mostly studies religion as if it were a commodity and the church as if it were a business firm (see, e.g. Iannaccone 1998; McCleary 2011).

Fascinating as these investigations are, this paper stays away from their approach. The abstract discussion is too abstract: values are everywhere; the practical discussion is too practical: money is everywhere, even in the church. In between, there are the traditional lines of analysis, which find in the Bible the original source of relationships between religion and economics and range from the very broad—religion affects everything—to the very specific, especially how to conduct business. They include the old quest concerning the effects of Protestantism on economic growth (Weber 1930; Fanfani 2003) and focus on the search for the roots of what today is called business ethics. This literature is well represented in the Talmudic branch (see, e.g. Mangeloja 2004), the Protestant branch (see, e.g. North 1973; Rushdoony 1984), and the Catholic branch of religion (see especially authors who treat the entry “social justice”). Each branch has naturally tended to interpret Biblical texts for its own specific purposes, from the homiletic to the political and ideological. Invaluable insights can also be gathered from the growing economics literature on Islamic (e.g. Kuran 1995), Buddhist (e.g. Zsolnai 2009), and Hindu (Bokare 1993) tradition.

Biblical and other religious texts mostly remain sources of inspiration as legal, moral, and spiritual authority.

This paper is a historical examination of a question that can be formulated in these terms: Has there ever been a set of intellectual and practical economic structures that allow for moral relationships to be commonly and comprehensively practiced among human beings? Morality is concisely considered as respect for one’s own and other people’s dignity as human beings; for a comprehensive definition of morality, see Gorga 2012. The “secular” reader can substitute integrity for dignity and should obtain the same results. The discussion can also be reduced to an inquiry concerning the application of fairness in all economic relations between human beings.

Using Concordian economics (Gorga 2002), in 2006 the writer cast a look backward in history and, to his continuing amazement, discovered the existence of a unique, self-enclosed, comprehensive body of doctrines that, as reported in Gorga (2010), can be classified as the economics of Moses and the economics of Jesus. To appreciate the inner coherence of these two doctrines, it is necessary to treat them separately. Hence, Part I attempts to reconstruct the economics of Moses; Part II the economics of Jesus. Part III touches lightly upon a host of questions raised by this work, and offers only meager answers. To give an indication of the magnitude of the task ahead, it might be pointed out that what needs to be fully evaluated is how much light this discovery sheds on about four thousand years of economic literature and practice.

To emphasize one set of issues, the writer approaches the relevant Biblical texts as if they were strictly economics texts. If the reader can read these texts in the same light as if they had been written, let us say, by Samuelson and Solow, the forbidding aura of the authors and quite possibly the preconceived biases against them, the rich theological implications, and deep complexities of Biblical exegesis are questions that—at least temporarily—can be set aside and reserved for examination once the economic import of those texts is fully evaluated.

We shall see that both sets of doctrines contain the whole world of economics, because—rather than starting from the economics of the household, as the Greeks did—they both address the whole of the economic process, which, as established by Classical economists, contains the study of production, distribution, and consumption of wealth. Of course, both Moses and Jesus explain theory and policy in accordance with the exigencies of their own historic moment. Hence, what changes is not the substance of their discourse but the literary expression and the response to immediate needs.

The paper attempts to demonstrate that both systems of thought represent not only an integration of economic theory, policy, and practice, but especially an integration of economics and morality. Hence, the central interest of this paper is to show that the two doctrines together form an integrated system of thought that might be called the economics of morality. We shall see that this system of thought yields rules that are applied freely and are just. Economic morality is defined as the application of economic justice. This is a topic that has its own vast literature (see, Gorga 2007), whose theoretical implications are cut short here by the observation that economic relationships are mutual relationships, thus one can objectively measure the value of what one gives and what one receives; one can objectively measure economic justice.

PART I — The Economics of Moses

The economics of Moses is contained in two fundamental doctrines: Observe Jubilee (including Sabbath and Sabbatical year) and Do Not Steal. The first is enunciated in Ex 20:8-11; 34:21; Lev 23:3; 25:2-16, 23-28; Num 33:53-54; 34; and Deut 5:12-15; 15:1; the second in Ex 20:15 and Deut 5:19.

1. Observe Jubilee

What is the doctrine of the Jubilee? There are many facets to this doctrine which lie outside the scope of this paper (Cf. Harris 1996; Trocmé 1973). Our focus is on its economic content. This is an economic doctrine and practice of subtle complexity. There are three aspects to it: They concern land, money, and products-things-time.

Jubilee Concerning Land

Economists might want to study the medium term injunction of the Jubilee, liberally extended to cover the Sabbatical and everyday practices. This is the injunction to leave the land fallow every seven years—namely, to let it organically rest so that it will recover its powers naturally, rather than force feeding it with chemicals. (Because of the savings involved in any reduction of chemicals and smaller external costs of clearing the effects of chemicals from the waters downstream and eventually the water table, economists may wish to give this practice more than a fleeting glance. The appetite for the economics of pesticides might be wetted by the knowledge that pesticides—while harming human health and the ozone layer—are used, not to enhance the productivity of the land, as to eliminate blemishes from the produce’s appearance.)

Our main concern is with the long term economic—and, necessarily, legal and moral—aspects of the Jubilee in relation to the land. By the end of the 49th year, the doctrine calls for the return of the land to the original possessor. Hence, on the 50th year—the Jubilee year—the slate is clean. Just as with the U.S. Homestead Act of 1862 or in the Amish community and Bali today, the original possessor acquires land at no cost (Num 33:53-54; 34), a gift from inheritance. The responsibility is to till the land.

The purely economic aspects of the Jubilee are revealed by the practice of purchase and sale of land during the forty-nine years preceding the Jubilee; by the existence of price; and by the existence of market. These three aspects are coordinated to such an extent that, with passage of time, the price of the land—astonishingly—goes progressively down to zero the closer one gets to the year of the Jubilee (see Lev 25:13-16; 27:16-24). How is that accomplished?

The three long term economic aspects of the Jubilee concerning the land bear deep examination. And they can be better understood by indirection. Purchase and sale of land could have been prohibited; and there would have been no market, and thus no price. The price mechanism of the Jubilee calls for close attention. Since the price of land decreases with the passage of time, the arrangement reveals that there was the observation of an inner coordination of events in the application of the Jubilee: First, everyone obeyed the mechanism; since there is no evidence of compulsion, everyone obeyed it voluntarily; and since the price of the land decreased over time, it was clearly responding to a framework of economic analysis. What was this framework? The process of price determination becomes reproducible and decipherable as one looks at the economic, the legal, and the moral context into which the purchase and sale of land was taking place.

The Economic Context. To see the various relationships involved in the institution of the Jubilee, it is useful to reproduce an analytic framework, which is here represented in a mathematical, logical, and a geometric format. We will observe this framework first in broad general terms and then we will fill in some of the specifics.

The framework constitutes an application of the principle of equivalence, which mathematically is represented as

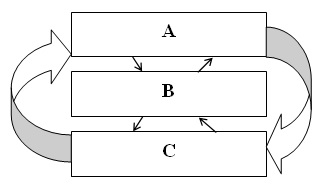

A  B B  C. To emphasize the reciprocal set of relations among the terms, the principle can also be represented as A ↔ B ↔ C. As emphasized by both mathematicians and logicians, the principle of equivalence yields nine sets of proofs because each term has to be reflexive (identical to itself throughout the discussion), symmetric (one term can be replaced by another and, while observing the same reality from a different point of view, yield a congruent set of conclusions) and transitive (the conversation has to be extended to a third term because, as e.g. Allen 1970, p. 748, pointed out, the relation of equivalence is of broader application than the relation of equality). Geometrically, one can represent the principle of equivalence in the following format: C. To emphasize the reciprocal set of relations among the terms, the principle can also be represented as A ↔ B ↔ C. As emphasized by both mathematicians and logicians, the principle of equivalence yields nine sets of proofs because each term has to be reflexive (identical to itself throughout the discussion), symmetric (one term can be replaced by another and, while observing the same reality from a different point of view, yield a congruent set of conclusions) and transitive (the conversation has to be extended to a third term because, as e.g. Allen 1970, p. 748, pointed out, the relation of equivalence is of broader application than the relation of equality). Geometrically, one can represent the principle of equivalence in the following format:

Figure 1. A Geometric Representation of the Principle of Equivalence

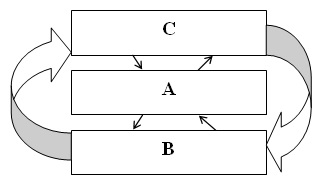

Or this format:

Figure 2. The Interchangeability of Terms in the Principle of Equivalence

Figure 2 indicates that the relation of equivalence presents us with a construct that is organic, rather than linear. The terms A, B, and C are complete entities in themselves, and they do not stand alone, but are put in relation with each other. One can therefore enter the discussion at any point and will—or should—obtain the same set of results.

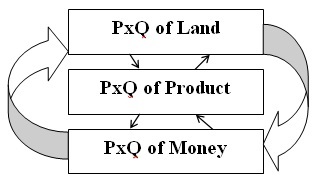

Let us now be specific. In order to understand the inner organic validity of the Jubilee, we have to be concerned with three entities all at once: namely, land, product, and money—or more precisely still, the value (Price times Quantity) of land, value of product, and value of money. In this fashion:

Figure 3. A Framework of Economic Analysis

The process of price determination for the land established an equivalence—in conditions of equilibrium, a constant one to one relation—among three elements: price times quantity of land, price times quantity of product, and price times quantity of money. This process was dynamic. With the exception of the quantity of land—each specific plot of land and presumably its fertility were stable—all the other factors were changing over time. Over time the price of the land went down, because—clearly—the cumulative quantity of fruit that the owner would derive from the purchased plot of land went progressively down to zero as the end of the 49th year was approaching. The economic basis of the sliding scale for calculating the price of the land at any given moment is evident: there was less fruit to be gathered as time progressed. Yet, what is not evident is that the economic system relied on the constancy of two hidden independent relationships—so they could remain in constant relationship with each other : the price of the product and the value (quantity times price) of money in their relation to the quantity of money had to remain constant, explicitly:

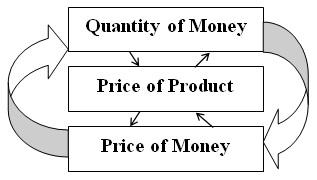

Figure 4. The Monetary Mechanism

The unit price of the fruit of the land had to remain constant over time; and the value of money also had to remain constant over time—otherwise, it would have been impossible to determine the price of a plot of land at any point in time. To wit, if the price of the fruit were to increase over time, then the price of the land could either remain constant—rather than decrease—or even increase over time. Ditto for any variation in the value of money.

We shall investigate the issue of the value of money after analyzing the legal and moral context in which the Jubilee was carried out. Here it might be worth to remain a little longer on the issue of the constancy of the price of the fruit of the land. Assume zero initial capital expenditure (the land was gifted, not purchased), constant labor costs, and no technological innovation over time (technological improvements used to move at glacial pace), the cost of the product ought to remain constant. (Indeed, with technological innovation, as current market trends in computers demonstrate, in a regimen of near perfect competition the price of a product will decrease).

The Legal Context. The legal operative word is stewardship. As distinguished from “things” that we create and on which we have legitimate property rights, the land belongs neither to its possessor, nor to the government. The owner of the land is Yahweh. “The land is mine,” says Yahweh (Lev 25:23). It is Yahweh who gives the land to each family of the tribes of Israel—except the Levi (Num 18:20) who were expected to live on part of the tithe (Num 18:24-30; Cf. Kelly 2004). If one possessor encounters troubled economic waters, one can sell the fruit of the land. But the owner of the land remains Yahweh. And the price of the land goes down because at the Jubilee year the land goes back to the original possessor. Thus, the decreasing price makes it possible for the buyer to receive a compensation equivalent to the value of product that might be obtained until the 49th year of the Jubilee cycle. And, incidentally, it is worth noticing that it becomes less traumatic and more palatable to transfer back to the original possessor a plot of land whose residual market value goes down to zero—instead of remaining constant or increasing—as the Jubilee year approaches. (Urban houses are treated like consumer goods. They are not returned to the original owner, specifies Myron S. Geller, unless redeemed.)

The Moral Context. In Israel there was a moral obligation to return the land to the original possessor at the Jubilee year. Why this command? Why the acceptance of this command by the people—at least in the beginning? The reason is clear. The person without access to land and natural resources is not a free man or woman. This person has lost the most fundamental of God’s gifts to man; he has lost his freedom. The loop is closed, the inner mechanism of the economics of Moses becomes clear as soon as it is realized—as modern economic theory from Adam Smith onward has made clear—that freedom is an essential component of economic growth. No freedom, no wealth.

Take away economic freedom from your neighbor and both you and your neighbor become poorer. Your nation becomes poorer. Thus the practice of the Jubilee concerning land does not only have internal legal and moral integrity, it makes unexceptionable and irreproachable economic sense. [Especially in olden days, access to land was an essential component of economic freedom. Concentration of the land in a few hands restricts the economic freedom existing in a nation. The injunction of the Jubilee concerning land is an essential tool of an economic policy that wants to prevent concentration of wealth in a few hands and to preserve economic freedom for the nation as a whole.]

Let us now observe the inner mechanism of the Jubilee concerning money. Similarities and differences with the theory and practice of the Jubilee concerning land are quite instructive. Naturally, one reinforces the other.

Jubilee Concerning Money

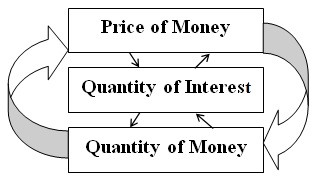

The second plank of the Jubilee is the injunction that during the seventh year all personal debts among the Hebrews (only) are to be extinguished. This injunction—if ever practiced, especially outside of kinship, specifies Myron Geller—can be understood when it is inserted into a monetary framework that is dominated by these three fundamental propositions: Gold, or an equivalent commodity, is money. Debt is not money. Interest rate is zero or very near zero. To analyze these propositions, let us reconstruct the monetary framework which led the Israelites to their unique injunction. Three elements are in proportional relationship:

Figure 5. A Monetary Framework

In the beginning the supply of gold, being a global commodity, increased—though in spurts—at a near constant rate with the increase of the population. Hence, since its per capita utility was rather constant, the price of money was stable. The interest rate was zero (Deut 23:19-20; Lev 25:36-37) because the gold nugget or coin that was returned was the same as—or an equivalent to—the one borrowed; in this case the value implicit in the use of the nugget was a definite gift from the lender to the borrower. (In the beginning, unless other arrangements were instituted, in order to avoid paying or receiving a 100% interest rate in addition to the return of the capital, one would have had to break apart the nugget or the coin—a difficulty that was eventually obviated by issuing coins of smaller and smaller denominations. And if in time a reasonable interest rate was charged, one still remained within the bounds of the economics of the Jubilee.) In the beginning, money as debt did not exist. The relation between debtor and creditor remained personal and static. One did not buy or sell debt. Who would want to buy an “asset”—debt—that bears low or no interest and whose value becomes zero when the Jubilee year comes due? For an in-depth treatment of interest in ancient times, see, e.g., Hudson (2000).

But why did the value of debt become zero when the seventh year arrived? The practical reason is that the borrower had almost certainly spent the nugget or the coin borrowed and was now penniless: Personal peonage did exist, but was subject to the same rules as those concerning monetary debt (see Lev 25:39-55). The cancellation of debt and the redemption from peonage renders men free again—and free human beings produce more than slaves and peons. The theoretical reason is that the cancellation of debt on the seventh year was the capstone that held an extremely delicate set of checks and balances together: The interest rate was null or very low and certainly there was no such construct as compound interest; debt had no value of its own; indeed, gold used as cash had—literally—a carrying cost and was not much subject to inflation or deflation. These relationships persisted as long as the Jubilee and Sabbatical were practiced.

Figure 5 helps us understand these relationships in mathematical terms: all three terms have a value of zero, a perfect instantaneous equilibrium that was reached on the year of the Jubilee. True, Figure 5 relates only values and relationships among individual private citizen; hence, it represents microeconomic events par excellence. The macroeconomic relations must be disposed of very briefly in this context: first, the wealth of nations is an abstraction; second, money acquires value only at the moment of exchange—without an exchange, the value of money is zero.

Apart from the internal coherence of the system, where is the fundamental justification for the cancellation of debts during the seventh year? The case of land is clear. Yahweh creates the land; therefore, Yahweh remains its owner in perpetuity. But who creates money? Unless other textual evidence is brought forward, there is only one expression that clarifies the issue. The expression comes from Lk 20:24-25, in which Jesus, upon being shown a denarius, asked: “Whose portrait and inscription are on it?” “Caesar's," they replied. He said to them, "Then give to Caesar what is Caesar's.” This is who Jesus understood to be the intermediate owner of money: Caesar; the government.

But wait. Who is the King in the Jewish tradition? What is the government? The King is anointed by Yahweh. The King and the government are representatives of Yahweh. The money, then, is as much a good that comes from Yahweh as the land. (And this, incidentally, is the foundational reason for the institution of the tithe [see Gn 14:20; Lev 27:30; and Deut 14:22]. The tithe is similar to the first fruit that in Greece or Rome and other ancient societies, and in Bali today, is given to the gods).

Thus the Jubilee/Sabbatical concerning money, the remission of all debts every seventh year, makes as much sense as the restitution of the land to the original possessor. This injunction of the Jubilee concerning money possesses just as much internal logic, as well as legal and moral integrity, as the Jubilee concerning land. The unexceptionable and irreproachable economic sense of the Jubilee concerning the land is redoubled when it assumes the form of the cancellation of debts—the cancellation of the duty to restitute wealth that is no longer there. Yet, to make the issues more deeply understood, perhaps one must ask: what is money?

Money. There is no definition of money in economic theory. And there can be none. In economic theory, there is only an explanation of the functions of money: a store of value, a means of exchange, and a tool of accounting. These, to emphasize the point, are the functions of money. For a definition of money, one must go to the law. One can then say with certainty what money is: Money is a contract. Money is a contract between the holder of the coin—or the note—and society. It is society as a whole that gives value to the money. It is the sweat and tears of all the people that give value to money. The King, or the government, as representative of society as a whole, only vouches for its mint condition and guarantees the value of money.

Both money and land are common goods, because they are both given value by the sweat and tears of all the people in the land. A rock in Arizona is nearly worthless; a rock of the same size in Manhattan is worth gazillions. To repeat, the Jubilee does not only have internal logical, legal, and moral integrity, it makes unexceptionable and irreproachable economic sense. The practice of cancellation of debt every seventh year was an acceptance of reality and an institution of peace: one cannot spill blood from a stone. The alternative is to enslave debtors. Yet, debtors produce nothing if incarcerated—indeed, they cost money for sustenance—and slaves produce less than free men. Hence, society as a whole, just as in the case of the land, is worse off through the pursuance of sleek economic practices. These practices are generally tolerated because the cost of the sustenance of the debtor in jail is borne, not by the creditor, but by society.

This analysis is confirmed by a view of the monetary system as a whole. The monetary system has to integrate three elements: (1) a coin or a bill is to be made equivalent to (2) a unit of currency—e.g. one dollar bill; and both have to be made equivalent to (3) some amount of real wealth. This third element is shattered into a large number of items. The functionality of the system is ultimately determined by the (culturally always changing) exchange values among these sets: one ounce of gold for one bushel of apples, and one bushel of apples for a carved walking stick, which at that one point in time must in turn be able to buy an ounce of gold. In a free economy, these exchange values are determined by the laws of supply and demand. Yet, this conclusion is much too hurried, because these exchange values are first determined by the number and the value of bills and coins in circulation. In other words, two thirds of monetary analysis consists of the determination of who issues the currency, conditions of issuance, and amount of currency in circulation. If the amount of currency determines the nominal value of the currency, then the essence of monetary policy consists of the determination of elements (1) and (2) above, namely who issues the currency and to whom is it issued—and, more specifically, the conditions under which the currency is created. To confine one’s observation to the third element of the monetary process is not wrong; it is an incomplete action. It is condemning oneself to a partial view of the process: It is as if, while diligently studying all twirls, all twists and turns, of the cat, one lost track of the cat. Worse. This is not simply a theoretical conclusion. To study only the third element of the monetary process, it is not simply to abandon monetary policy to the blind forces of the market. This enclosure of vision inexorably leads to the abandonment of monetary policy either to the bankers or the politicians.

In a duly constituted society it is not the creditor who creates the currency or its value, but the monetary authority in the context of the market. The monetary authority is thus fully entitled to cancel uncollectible debts. Hence, the monetary aspects of the Jubilee are in full accord with a complete understanding of the monetary system as a whole. Money is fiat money. Money is a common good. It should not be made into a means of control over people.

Jubilee Concerning Products-Things-Time

One meaning of Jubilee is not just restitution, but gift. There are many sides to these injunctions: One is economic, the others are legal, social, moral, and religious; today we might add one more dimension: psychological. The Israelites are enjoined to offer gifts to the passerby, the sojourner, and the poor. A list of injunctions runs as follows: At all times, leave the corn stalk at the edge of the field untouched; leave the fruit on the lower branches of the tree untouched; leave whatever stock of grain falls from your cart so that any passerby can avail himself of this bounty—no questions asked. This proviso is all important. Its importance is made manifest not so much by the intrusive questioning of the “welfare state” of today as by the extraordinary delicacy of moral sentiments epitomized by Maimonides, the Jewish sage of the XII century Spain in which the three monotheistic religions working together, not without shortcomings, created a splendid civilization. The practice of charity—the tzedakah—is codified in Maimonides’ “golden ladder,” in which (as in the Islamic practice of zakah) ultimately the line between morality and economics is overstepped and the wisdom to endow people with a business of their own is established. Why, one might ask? Because Maimonides and traditional Islamic jurists can be said to have discovered that competition is the soul of economic freedom.

The practical effects of these injunctions are multifaceted. Each injunction orders a transfer of wealth from a producer to a consumer—without any compensation, because, presumably, the passerby who avails himself of that bounty has no means to compensate the producer. The economic effect of this aspect of the Jubilee is straightforward. Consumption, as Adam Smith well knew, is “the sole end and purpose” of business: consumption completes the economic process. A penny is earned when a good is sold. If you cannot sell a product, first reduce its price—or make more money available to the consumer, as Henry Ford well knew—and then give it away This economic aspect of the Jubilee, liberally extended to cover the Sabbatical and everyday practices, should be most evident today. What board of directors will order an expansion of business when merchandise is stuck on the shelves?

The social/religious/moral/psychological effect of this aspect of the Jubilee resides in the meaning of Jubilee as freedom: freedom from attachment to products, attachment to things—which we create and on which we have proper property rights. To reemphasize, freedom from attachment to money. And to the list of attachments, today, one must add time. We are so attached to our freedom to do whatever we please with our time that we neglect to offer it, at least every seventh day, to our families and our communities—and ultimately to ourselves and preferably to God. How can the wisdom of the practice of the Sabbath have slid from our hands so irresponsibly? The guess is that we have not considered the many implications of free time. Perhaps it will help us to understand, if we decipher Pharaoh’s message contained in Ex 5:9 along such explicit lines as: “Let us so overwork the people that they will be incapable of listening to words of truth.” Perhaps it will help us to understand the need to abstain from work on the Sabbath day, if we consider the relationships between free time and all the work that needs to be done in order to insure one’s economic freedom: One needs to insure the health of one’s own physical body; one needs to insure the health of the political body of the nation. One needs to think. One needs to have the time to get out of one’s own limited shell. And of course the core of the Jewish message is that Yahweh grants us freedom to worship him without fear all the days of our life—a freedom that clearly extends to the choice not to worship him.

Only a saint could have understood the deepest possible aspects of the detachment from products, things, money, and even time. Saint Catherine of Siena says (1980, p. 322): “(Those who are detached from things) do not fear the bitterness of death.” The right relation with things, money, and time grants the greatest freedom of all: freedom from fear of dying—a fear experienced a thousand times by many a person who is abnormally attached to things. If in doubt, Google “hoarding” and be amazed at the findings.

2. Do Not Steal

Seen in the total complexity of the economic aspects of the Jubilee, the second doctrine of the economics of Moses—a well-known doctrine—ought to acquire its original full force: Do Not Steal. Do not steal money and do not steal land, it is clear, because they do not belong to you, or even to their possessors. They are common goods. Ultimately they both belong to Yahweh. If you steal land or money, you offend Yahweh—directly.

The injunction against stealing extends to consumer goods as well. And here the legal and moral foundation of the injunction is as strong as it can possibly be. In a primitive society, there is no mystery as to the origin of consumer goods. They issue directly from the sweat and tears of people. Hence, these goods belong to those who have created them. More. In a primitive society in which consumer goods are not only few but essential to life, stealing them is tantamount to killing other people.

Does one dare ask the quintessential moral-practical question: Is it all any different today? Are there not people starving—even starving to death—today?

This, of course, is a paper devoted to economics. Where is the economic rationale for the injunction against stealing? The forms of stealing are legion; and so are the costs of stealing. Unjustly dispossessed people are less productive than people who are secure in their possessions. Indeed, stealing is the ultimate form of corruption. Economics is just beginning to appreciate the costs of corruption in the business world—both within developed and developing countries. Would any financial crisis be as severe, if there were no corruption in high places? The morality of not-stealing is quickly stated: When you steal, you steal from yourself the opportunity of producing the thing yourself.

PART II — The Economics of Jesus

The economics of Jesus is a restatement of the economics of Moses and is contained in three fundamental doctrines. Two complementary doctrines are derived from the Parable of the Talents in Mt 25:14-30: The first doctrine states, Invest Your Talents; the second states, Do Not Hoard Your Talents. The third is enunciated in Mt 22:21: Give to Caesar What Is Caesar’s.

1. Invest Your Talents

The word “investment” had not been invented yet, but the practice was there from time immemorial—if not from the first appearance of men and women on earth. And so was the intellectual understanding that this practice revolves around three factors of production: land, capital, and labor. We have observed how Israel intellectually handled both money and land from Moses to Jesus. Why is labor not an essential component of the economics of Moses?

In the beginning there was work, but no “labor.” Every member of the tribes of Israel received a plot of land for his own use, except the Levi who were to live on the tithe, a gift representing 1/10 of other people’s income.. Therefore, everyone was an owner, not a worker or a laborer—and the practice of the Jubilee tended to reinforce this status. Hence, there was economic freedom in the land. There were no poor (Deut 15:4), or very few poor people. From Moses to the time of Jesus, investing was such a normal outcome of economic freedom that Moses did not have to speak of investing at all.

By the time of Jesus, evidently much economic freedom had already been eroded. The Jubilee was no longer practiced. Indeed, with the Roman conquest the Mosaic mantel of stewardship over land and money was captured by the Roman institution of private property. Acquisition was in the saddle. Most people lost possession of their land and debts impoverished them even faster. Some people became laborers. Jesus has a forceful account of the condition of labor. Mt 20:8-15 gives this parable of the workers in the vineyard who at the end of the day

…lined up to receive their pay. The ones hired last were paid first. Having worked but an hour, they didn't expect much. To their surprise and delight, however, they each received a full denarius. When the workers who were hired first saw this, they—forgetting their bargain—became happily expectant. If that was what the employer was paying to those who had worked but a single hour, then how much more would they have coming! So they thought. When they received their own pay, however, it was but one denarius, like the others. Their fallen expectation turned to bitterness, and they confronted the employer, saying: "These last have wrought but one hour, yet thou hast made them equal to us, who have bourne the burden and the heat of the entire day.” The employer, however, was not impressed. To one of them, he replied: "Friend, I am not being unfair to you. Didn't you agree to work for a denarius? Take your pay and go. I want to give this man who was hired last the same as I gave you. Don't I have the right to do what I want with my own money? Or are you envious because I am generous?"

As all parables, this too has received a myriad of interpretations. The present context suggests this meaning. This is what Jesus seems to say: "Yahweh gave you possession of the land; Moses gave you the Jubilee to correct your possible economic mistakes. If you tolerate a system in which there is no Jubilee or any of its equivalents, you have no economic freedom. You have a system of masters and slaves. And, legally as well as theologically, you cannot tell the master what to do. You can cry to high haven, but not even God is going to listen to you. Either you regain your God-given economic freedom, whereby you yourself (in concord with other co-owners if you have any) have the right to reward your endeavors in accordance with what you think is just, or you simply have to accept what the master decides to give you—no matter how arbitrary; no matter how unjust; no matter, even, how generous that reward is."

Jesus thus emphasizes what Moses implied and what (almost) every Classical economist was later to emphasize: Take proper care of (the ownership of) land, capital, and labor and economic growth will result as a normal outcome of economic freedom.

Economic Growth as a Normal Outcome of Economic Freedom

A pause is in order. Is not morality supposed to constrain economic freedom? Is there not supposed to be a conflict between morality and economics? Jesus did not seem to be aware of it; and, indeed, this conflict is not a postulate of modern economics; the moral consequences of economics are immaterial to economists. Therefore, the separation of morality from economics that is very dear to ideologues can be considered as a transient phenomenon, a transient aberration that time will allow us to forget. Certainly this is a topic that requires intense examination. Here we can only distil the extended analysis into the following proposition: Human beings are free—not to choose between Gucci and Pucci—but between good and evil. Jesus was very specific as to what he meant by morality. He did not fall into the trap of determining for others what is good or evil. Jesus did not make this severe strategic error. As outstanding proofs, he did not suggest any external restriction on economic activity or any forcible transfer of wealth from one group of people to another. Hence, he would concur that economic activity must be free and he would add that morality cannot be imposed—or slapped on—from the outside, because then morality becomes empty of content. Either morality is within each and every decision that one takes or it is not there at all. Thus Jesus made it very clear that he wanted morality to be applied ever creatively. He wanted moral rules to be forever internalized. And easily memorized. He reduced the whole of morality in economics to two economic doctrines: Do not Hoard; Give to Caesar What Is Caesar's.

2. Do Not Hoard

The freedom to choose between Gucci and Pucci is not an economic decision. It is an esthetic decision. The economic decision is whether to spend one’s income and wealth on consumer and capital goods or to hoard it. Analysis shows that this choice is more than a simple economic decision; it is an intrinsically moral decision with clearly identifiable economic consequences. Jesus was extraordinarily firm about this choice, which—since reasonable people are assumed to buy consumer goods only as they need them and moral people are supposed to know how to choose between buying another Gucci bag or giving the money to the neighbor who is starving—he characteristically reduced it to the choice between investing and hoarding. In the Parable of the Talents as written in Mt 25:14-30, Jesus so forcefully applauded using wealth creatively that all the wealth was donated to those who had doubled it—and they were enthusiastically entrusted with the administration of much more wealth. Clearly, Jesus so applauded investing because moral people are supposed to know the difference between producing a Gucci bag or a loaf of bread. By the same token, Jesus so strongly condemned hoarding as to take the one talent away from the person who, for fear of losing it, planted it underground where it could do no good for anyone. Much more. This person was ordered to be cast into hell, literally “the outer darkness; (w)here men will weep and gnash their teeth.” No appeal. No mercy. Totally uncharacteristically.

As expressed in the Jewish Law, the injunction against hoarding is presented as a list of positive activities, which in a decreasing order of importance can be enumerated as follows: return the land to the original possessor every fifty years; cancel all existing debts every seven years; let the land lie fallow every seven years; reserve the Sabbath, the seventh day of the week, for God and community, for family, and for yourself; leave the corn stalk at the hedge of the field untouched; leave the fruit on the lower branches of the tree untouched; leave whatever stock of grain falls from your cart so that any passerby can avail himself of this bounty—no questions asked, no compensation required.

Jesus synthesized the list of positive actions prescribed by the Mosaic law and the Jewish prophets into a negative injunction: Do not hoard. Thus he generalized and extended the original formulation of this injunction, by including in it all forms of hoarding. This formulation has a set of explicatory characteristics of its own. In it, the economic—as distinguished from the theocratic and moral—aspects of the Jubilee become exceedingly transparent. The fundamental reason why at the appointed years the land had to be returned to the original tiller and debts had to be cancelled was to prevent hoarding: the inordinate accumulation of wealth in the hands of the few—and the consequent deprivation for the many of the means of sustenance. With the amount of wealth being finite at any particular moment, when the few have too much, the many have too little. (Technically, wealth hoarded is only wealth that is used neither as a consumer good nor as a capital good. The land ordered back to the original possessor might not have all been hoarded. Yet, most of it was—as the existence of much unused land indicated.)

Jesus was very clear as to this relationship. For him cause and effect was so immediate that he emphasized in no uncertain terms the destination of the wealth not to be hoarded: It ought to be given to the poor. He felt so strongly about the issue that he personalized it. He said in Mt 25:40: “whatever you did for one of the least of these brothers of mine, you did for me.”

Why did Jesus emphasize so forcefully the need of giving to the poor? Generally, this injunction is characterized as being a moral injunction. And that is certainly true; but it is not a sufficient interpretation of Jesus’ position. It is the economic content of this injunction that links the economics of Moses to the economics of Jesus and gives substance to the moral injunction of giving to the poor: giving to the poor not just a pittance, but giving them what is their due. We have so far seen that the Israelites by not practicing any of the forms of the Jubilee had gradually lost their original economic freedom. And the number of poor people was growing at an intolerable pace. Certainly, there were many more poor people at the time of Jesus than at the time of Moses. But this is a historical fact that does not explain much; indeed, it is a trend that needs to be explained. A major institutional change occurred from the time of Moses to the time of Jesus. Hebrew stewardship of land and money was transformed into Roman private ownership of land and money: land and money were privatized. These common goods could then be accumulated beyond the requirement of the satisfaction of one’s needs. The latifundia—those exceedingly large estates that still plague the world today—were born; and the insidious accumulation of financial resources was beginning to be felt in the economic system. A part of these resources was accumulated and kept idle—all the while people were excluded from their utilization and were made poor as a consequence. With the latifundia came poverty.

This, then, is the first essential characteristics of Jesus’ doctrine of not hoarding. By turning his own negative doctrine (do not hoard) into a positive injunction (give to the poor), the doctrine acquires an economic content that does not stand in a vacuum but is immediately related to the rest of society. The poor are poor not because the rich are rich nor because the rich are the creators of poverty (Cf. Gorga 1998)—Jesus had nothing against the rich. The poor are poor because the rich have too much, too much they do not need. The second essential characteristic of Jesus’ doctrine of not hoarding is this. It places the primary responsibility for not hoarding, implicitly on society and the law, but explicitly on individual conscience. Hoarding clearly becomes a moral issue with distinct economic consequences. Dishoarding becomes a voluntary act. Jesus wanted each one of us to be convinced of the importance of our own rights and responsibilities and to act upon them. Jesus did not start an economic movement. The third essential characteristic of Jesus’ doctrine of not hoarding is this: Do not wait forty-nine years before divesting yourself of unneeded wealth. The time to dishoard is now. And with this he exalted the value of practices recommended in Mosaic and rabbinic law.

A Modern Chorus of Disapproval

Having lost the memory of the past, most economists stand ready to proclaim the inevitability of the present. At this juncture in the conversation, joining their voices to a chorus of free-marketers (who assume that morality is practiced, as it is practiced, by all self-respecting economic agents) and winner-take-all analysts who study the economics of gambling and Hollywood stardom, most economists are likely to pitch in and say: “The forces of the market, rather than justifying the economics of Moses and Jesus, prove that wealth accumulation—which is not recognized as being, in part, hoarding—is ‘natural’ and ‘inevitable.’ After all, did not Jesus, in Mt 26:11, quoting Deut 15:11, say, ‘The poor will always be with you’”? These analysts have not factored in their analysis the distinction between hoarding ex post and hoarding ex ante. In so doing, they let the mechanics of hoarding pass under their radar undetected. Jesus was concerned with both stages of hoarding. He did not only say “Do Not Hoard” and, if you happened to have hoarded in the past, “Dishoard Now.” Perhaps he was even more concerned with preventing hoarding from happening at all. He went after hoarding at its roots. He also said: “Give to Caesar What Is Caesar’s.” The evidence is strong that inordinate accumulation of wealth is due to the contravention of this last doctrine.

3. Give to Caesar What Is Caesar’s

The third economic doctrine of Jesus, Give to Caesar What Is Caesar’s, has traditionally been interpreted too narrowly. Betraying their intellectual roots in the work of Consultant Administrators from the fifteenth century Italy, modern economists have limited the application of this doctrine to the relationship between government and the governed. Thus, having abandoned monetary policy into the hands of the bankers, modern economists have not only reduced economic policy to fiscalism; more seriously still, they have restricted the vision of the economics of Jesus to a master/servant relationship. To understand the full import of the third economic doctrine of Jesus, we need to enlarge its range of applicability by enveloping the entire gamut of relations that exist among free men and women. Once one observes the whole economic process, as Classical economists did and as Keynes or Hayek did, then the third economic doctrine of Jesus reveals its not surprising complexity. The third doctrine then reads as follows: give the other fellow what is his due. This, as it has been known from Aristotle onward, is the very essence of economic justice. Once that is done, we shall see that giving to Caesar what is Caesar’s is nothing but the application of Moses Law: Do not steal. Jesus did not present any new proposition in Jewish Law. He simply transformed a negative Mosaic commandment, “Do not steal,” into a positive injunction: “Do Justice.” Thus he followed Deut 16:20.

Clearly, Jesus not only explicitly called for the application of Moses’ Jubilee (esp. Lk 4:16-32 read with the help of Trocmé 1973, pp. 26-29); to preserve their spirit, he changed the form of Moses’ injunctions and adapted them to the needs of the moment. To become aware of this transformation in no uncertain terms, let us leave petty larceny well alone. Putting substance into this third doctrine, and casting it into the framework of modern institutions, this is what transpires. When people do not pay the full share of the taxes they owe, especially taxes on land and natural resources, they steal from fellow citizens who are burdened with the total share of the costs of running a country. When the central bank sells a pool of common wealth—i.e., national credit—to preferred customers, the central bank sells for a mess of pottage a national treasure that belongs to the entire population. Private appropriation of common goods—such as land and money—without compensation is expropriation and plunder. When stockholders cash in the value of their stocks and bonds, they rob the workers who have originally contributed to the creation of that value—and are excluded from that bounty by the faulty legal institute of the “wage contract.” When one purchases a whole corporation, and uses other people’s money to concentrate the wealth of the nation into fewer and fewer hands, one robs at least the workers, if not also the previous as well as future potential stockholders, of the ensuing capital appreciation of the corporation.

Set these four economic mechanisms of capital accumulation aright, and hoarding is cut at its root. You Give to Caesar What Is Caesar’s: Do not steal is a commandment. You do justice and receive justice. With a just distribution of wealth, there is no need for its redistribution.

Part III — Many Questions, Few Answers

Clearly, this presentation raises many questions in many fields, and the writer offers few answers. The hope is that, once it is ascertained that the paper has fundamental validity, other scholars will intervene and provide satisfactory answers. First, there is a whole set of questions relating to standard issues of scholarship. How reliable are the texts cited here? Are there better—or, even, contradictory texts—that the reader has to be made aware of? How reliable is the attribution of each quotation to their assumed authors? The writer, being a fervent Catholic, has taken these issues at face value, but if challenged he cannot provide reassuring answers.

Then there is a host of issues relating to the historic application of the tenets contained in the texts cited. Which forms of the Jubilee were practiced, if indeed they were ever practiced at all? For how long were they practiced? And precisely when? Why were they discontinued—as it is indeed clear they were? To this set of important questions the writer has one general but overriding answer. Even if they were applied only once, one can say that the world fully respected the principles of economic justice once. And if they were never applied, one can still say that the Israelites had the moral integrity to imagine and to fashion the intellectual conditions of economic justice.

And, of course, such an answer triggers many more questions. Were Moses and Jesus, implicitly or explicitly, aware of the relationships between their systems of thought and the doctrine of economic justice? Can such a relationship be firmly established? If it can, how specifically was it met by Saint Thomas Aquinas, once he accepted the Aristotelian doctrine of economic justice? Was, indeed, Saint Thomas aware of the economic content of Moses and Jesus teachings?

And then a whole flood of other questions comes to the fore. Clearly the issues are terribly complex and might become terribly contentious. To avoid such a disaster, only a few additional points will be raised in the following paragraphs. One question, for instance, concerns the issue whether historical conditions are ripe to have a full application of the economics of Moses and the economics of Jesus today or at any time in the foreseeable future? The answer is mostly negative. Yet, as pointed out elsewhere (especially in Gorga 2009), even in the complexities of the modern world, it is fully possible to apply, not the letter, but the spirit of this system of thought.

Would the economics of Moses and the economics of Jesus have ever been practiced in a non-theocratic society? The answer is an undiluted, Yes. They have been practiced since time immemorial, and are still being practiced: in the commons, until the commons are enclosed. The size of the economy is not the issue, either. The economics of Moses and the economics of Jesus were largely practiced by the American Indians over the vast prairies when they were free—as well as by American colonists and citizens up to the Civil War perhaps.

Nor are there limitations of time. From Moses to Locke, everyone agreed that economic life is covered—in one fashion or another—by the moral law. The understanding of this complex interlacing of moral and economic injunctions was held astonishingly constant over time. This view, confirms Wood (2002, p. 83), was in the late Renaissance “the same as Aristotle’s.” It is only from the time of Adam Smith onward that there has been a breach in this tradition. (To repeat, free marketers assume that this reality still prevails—and, in a fundamental way, they are right.)

With Adam Smith’s Theory of Moral Sentiments (1759, e.g. I.I.43), the authority of religion is expunged from the moral sciences and substituted with the authority of the “impartial spectator.” This construct sounds so creative and impressive as to endure through the ages—until one asks: But who precisely is this person? Then the answer resounds loud and clear: lui meme, he himself, of course. Morality is out; narcissism is in.

In logically flawless correspondence, with Adam Smith’s Wealth of Nation (1776, especially Bk. V, ch.1, 158, 191, and 219) morality is explicitly expunged from economics and substituted with a presumed neutrality of the sciences: To paraphrase only slightly, who would ever want to follow “the morality of the (drunken) monks”?

Modern economics, the economics founded by Adam Smith, it is widely maintained, is a science—indeed, a mathematical and an autonomous science. As such, economics is supposed to be studied by itself and, certainly, its internal cohesion precludes the examination of any external consideration; especially any consideration regarding morality. These statements, by themselves, are inarguable. Yet, as most people sense, they are fallacious. Their fallacy is revealed only realizing that they do not stand alone but are part of an intellectual system of thought—the Enlightenment Project—whose fundamental propositions are as follows:

1. Freedom → 8

2. Morality → 0

3. (Monetary) Efficiency = 1 (sole value)

4. Economic agents = | | (isolated logical automatons)

5. Community → 0

One can easily demonstrate that not one of these propositions stands at the touch of reason.

Conclusion

Unexpectedly, going as far back into recorded history as possible, one finds two systems of economic thought whose moral values are inherent and inseparable from them. They are the economics of Moses and the economics of Jesus. Analysis reveals that they are so integrated into each other that one can speak of one system of thought: the economics of morality. We have seen that this system of economic theory ran seamlessly into economic policy and, merged with the Aristotelian doctrine of economic justice, reigned in one form or another from Moses to Adam Smith.

The substance of the economics of Moses and the economics of Jesus can be summarized simply. Morality creates freedom; and freedom creates wealth. The freedom of wealth acquired in justice ultimately produces jubilation in the heart. That is—or should be—the ultimate aim of the study and the practices of economics.

The exploration of whether the economics of morality can be adapted to the modern world is an ongoing task for this writer; an essential task, in his estimation. But certainly, no one writer can do it all, and no one paper—or even a few papers or books—can say it all. Assistance from any and all will be most welcome.

Postscript

Perhaps, this paper will become much clearer if I specify that the core of the economics of morality given above forms the backbone of the four economic rights and responsibilities elaborated upon in many of my papers: see, e.g., “Four Economic Rights: Social Renewal Through Economic Justice for All”.

It might be useful, therefore, to repeat that core. The core of the economics of morality is this:

When people do not pay the full share of the taxes they owe, especially taxes on land and natural resources, they steal from fellow citizens who are burdened with the total share of the costs of running a country. When the central bank sells a pool of common wealth—i.e., national credit—to preferred customers, the central bank sells for a mess of pottage a national treasure that belongs to the entire population. Private appropriation of common goods—such as land and money—without compensation is expropriation and plunder. When stockholders cash in the value of their stocks and bonds, they rob the workers who have originally contributed to the creation of that value—and are excluded from that bounty by the faulty legal institute of the “wage contract.” When one purchases a whole corporation, and uses other people’s money to concentrate the wealth of the nation into fewer and fewer hands, one robs at least the workers, if not also the previous as well as future potential stockholders, of the ensuing capital appreciation of the corporation.

Concordian economic practice presents the following integrated set of rights and responsibilities: the right of access to land and natural resources and the responsibility to pay taxes on that portion of land and natural resources that fall under our exclusive control; the right of access to national credit and the responsibility to repay loans acquired through national credit; the right to the fruits of one’s labor and the responsibility to contribute to the process of creation of wealth; the right to the enjoyment of one’s wealth and the responsibility to respect the wealth of others.

Acknowledgments: Unique thanks for the framework of analysis on which this paper draws are due to 27 years of exhaustive probing by Franco Modigliani and 23 years of assistance from Meyer L. Burstein. Mitchell S. Lurio and Norman G. Kurland have been great teachers of economic policy. This paper is particularly due to persistent guidance by Wilfred Wolfsma. The paper has also benefited from wise and penetrating comments on previous drafts by two anonymous referees, as well as suggestions by Damon Cummings, Joshua Brackett, Joseph M. Patchett, and Ralph Cole Waddey. My collegue Peter J. Bearse offered invaluable editorial assistance—including the clarifying transformation of short connecting lines into directional arrows in figures.

References

Allen R. G. D. 1970, Mathematical Economics, 2nd ed., London and New York: Macmillan, St. Martin’s.

Bokare M.G. 1993, Hindu Economics. India: Janaki Prakashan Publisher.

Caplin A. and Schotter A. Eds. (2008): The Foundations of Positive and Normative Economics. New York, NY: Oxford University Press.

Catherine of Siena. 1980, The Dialogue. S. Noffke trans. Mahwah, NJ: The Paulist Press.

Fanfani A. 2003, Catholicism, Protestantism, and Capitalism. Norfolk, VA: IHS Press.

Gorga C. 1998, “The Creators of Poverty,” Gloucester Daily Times, Symposium, December 18, p. A10.

_____ . 2002, The Economic Process: An Instantaneous Non-Newtonian Picture. Lanham, MD and Oxford: University Press of America.

_____ . 2007, “Economic Justice.” In Encyclopedia of Catholic Social Thought, Social Science, and Social Policy (Lanham, MD: Scarecrow Press), 335-337.

_____ . 2009, “Concordian Economics: Tools to Return Relevance to Economics”, Forum for Social Economics, vol. 38 (1) 53-69.

_____ . 2010, “The Economics of Jubilation – Blinking Adam’s Fallacy Away,” in Albert Tavidze, ed., Progress in Economic Research, vol. 19, ch. 1. New York: Nova Science Publishers. Also available online at http://ssrn.com/author=856905 (2009 [2006]).

_____ . 2012. “A Contemporary Definition of Morality”, The Ethical Spectacle, November 2012.

Harris M. 1996, Proclaim Jubilee! A Spirituality for the Twenty-First Century. Louisville, KY: Westminster John Knox Press.

Hudson M. 2000. “How Interest Rates Were Set, 2500 BC – 1000 AD,” Journal of the Economic and Social History of the Orient 43 (Spring 2000):132-161.

Iannaccone L. R. 1998, An Introduction to the Economics of Religion. Journal of Economic Literature, September, 36, 1465-1496.

Kelly J. L. 2004, “The Tithe: Land Rent to God,” Acton Institute Religion & Liberty, July and August.

Kuran T. 2010, The Long Divergence: How Islamic Law Held Back the Middle East. Princeton, New Jersey: Princeton University Press.

Mangeloja E. 2004, Economic utopia of the Torah. Economic concepts of the Hebrew Bible interpreted according to the Rabbinical Literature. University of Jyvaskyla, no. 274.

McCleary R. M. (ed.) 2011, The Oxford Handbook of the Economics of Religion. New York, NY: Oxford University Press.

North G. 1973, Introduction to Christian Economics. I.C.E., Freebooks.

Rushdoony R. J. and Otto J. S. (eds.) 1984, Journal of Christian Reconstruction (Vol. 10, No. 2 (1984): Symposium on Christianity and Business. Vallecito, CA: Chalcedon Foundation.

Smith A. 1759, Theory of Moral Sentiments. London: A. Miller.

_____. 1776, An Inquiry into the Nature and Causes of the Wealth of Nations. London: Methuen & Co.

Trocmé A. 1973, Jesus and the Nonviolent Revolution. Scottdale PA, Kitchener: Ont.: Herald Press.

van de Weyer R. 2004, Zen Economics: Save the World and Yourself by Saving. Blue Ridge Summit, PA: O Books.

Weber M. 1930, The Protestant Ethic and the Spirit of Capitalism. London & Boston: Unwin Hyman.

Wood D. 2002, Medieval Economic Thought. Cambridge, UK: Cambridge University Press.

Zsolnai L. 2009, ”Buddhist Economics for Business.” Ethical Prospects Part 1, 89-9.

ABOUT THE AUTHOR

Carmine Gorga is a former Fulbright scholar and the recipient of a Council of Europe Scholarship for his dissertation on “The Political Thought of Louis D. Brandeis.” Dr. Gorga has transformed the linear world of economic theory into a relational discipline in which everything is related to everything else—internally as well as externally. He was assisted in this endeavor by many people, notably for twenty-seven years by Professor Franco Modigliani, a Nobel laureate in economics from MIT. The resulting work, The Economic Process: An Instantaneous Non-Newtonian Picture, was published in 2002. Dr. Gorga is president

of Polis-tics, Inc., a consulting firm in Gloucester, MA, and during the last few years has concentrated his attention on the requirements for the unification of economic theory and policy. He is currently working on a book entitled A New Monetary Order: Based on Rights, not Privilege. For details, see www.carmine-gorga.us.

|

|